4 December - European Autonomy

Europe’s strategic autonomy: emerging reality or political mirage?

Why Europe’s autonomy agenda is becoming a powerful catalyst for new investment cycles and sector-level opportunities.

Introduction

Europe is confronted with significant change. After five decades of steady globalisation and open trade, global integration is slowing — and in some areas, reversing. In 2024, former ECB chief Mario Draghi underscored the urgent need to strengthen Europe’s economic competitiveness, setting out more than 300 recommendations across key industries. The report[1] highlighted three central priorities: closing the innovation gap to reignite growth and address declining productivity amid demographic shifts; reducing strategic dependencies; and safeguarding the interests and well-being of European citizens.

In response, European strategic autonomy has emerged as a defining priority, with Europe seeking greater independence in policy, security and economic decision-making.

Why is strategic autonomy so vital for Europe?

Strategic autonomy underpins Europe’s ability to protect its interests in an increasingly uncertain world. Geopolitical tension, technological disruption and economic interdependence have exposed vulnerabilities — from energy dependence and fragmented defence capabilities to reliance on foreign technology and critical raw materials. At its core, it is Europe’s capacity to act independently in defence, foreign policy, the economy and technology, without undue reliance on external powers.

China’s growing assertiveness, the unpredictability of U.S. foreign policy, and the Russia–Ukraine war have underscored the urgency of a more self-reliant Europe. These developments have laid bare how dependent the EU still is on NATO and the United States for its defence and security.

The EU’s heavy reliance on Russian gas[2] emerged as a key vulnerability following the outbreak of the Russia–Ukraine conflict. This shock has highlighted the strategic necessity of greater control over Europe’s energy production and distribution — accelerating the shift toward renewables, diversified imports, a more resilient grid and the reconsideration of nuclear energy within a balanced energy mix.

Europe continues to trail the United States and China in critical technologies such as semiconductors, artificial intelligence, and cloud computing, creating economic and security risks. Achieving strategic autonomy requires Europe to secure its digital infrastructure, safeguard data, and maintain control over their essential technological capabilities. Rapid technological change is simultaneously creating new opportunities and new dependencies, exposing structural vulnerabilities across defence, energy, technology and supply chains.

The COVID-19 pandemic exposed the fragility of global supply chains, especially in pharmaceuticals, medical equipment, and semiconductors. Between 60% and 80% of active pharmaceutical ingredients are produced outside the EU[3], while roughly 60% of Europe’s energy[4] and most critical raw materials — such as rare earths and permanent magnets — are imported. Repatriating or diversifying production and sourcing is now seen as vital to Europe’s long-term resilience and strategic autonomy.

Europe: A geo-strategic awakening

Bold Goals

Europe’s “awakening” triggered a wave of strategic initiatives and policy actions to foster and finance the continent’s strategic autonomy whilst preserving its core values. Progress remains uneven: sectors such as transport, energy grid, critical raw materials and defence are moving ahead driven by political urgency.

Financing plan – Make Europe Great Again:

While the Draghi report estimates that Europe will require an additional EUR 750-800 bn in annual investment[5] (around 4.5% of 2023 EU GDP) from both the public and private sectors, several ambitious proposals have already been launched, signalling a shift from a market-driven approach to a more strategic industrial policy:

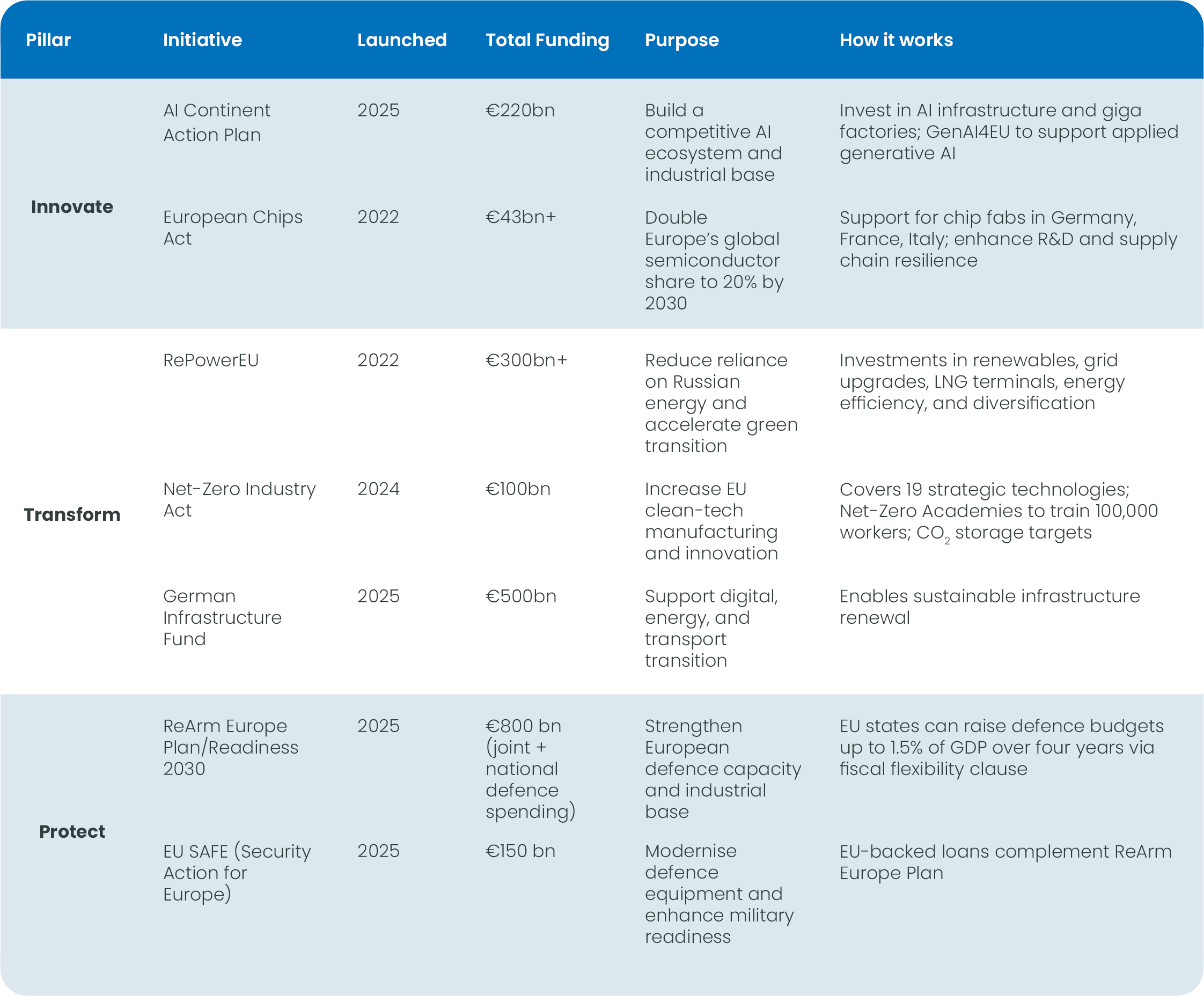

European initiatives powering strategic autonomy

Source: European Union: ReArm Europe Plan/Readiness 2030

All of these investment plans have been formally adopted or announced, though the degree of realisation varies:

- Some initiatives (such as REPowerEU, the Chips Act and the Net-Zero Industry Act) are more advanced and show measurable progress. Under REPowerEU, EU countries have already allocated €184 billion[6], just three years after the launch of the plan.

- Other initiatives (such as ReArm Europe and the Infrastructure Fund) remain in early stages of planning and mobilisation, with full implementation and large-scale spending still ahead. Nevertheless, progress is solid, with the €150 billion SAFE Plan already fully subscribed by 19 member states.[7]

Germany’s commitment to rearm and invest in infrastructure will lead to a substantial (20%) rise in bond issuance in 2026 (towards levels of € 350 bn). In contrast, additional defence spending for other Euro-zone countries will be more gradual while some also have less fiscal space.

What this means for investors

The scale of required investments across sectors is large, pointing to the importance of both public and private funding, and is now moving into tangible investment implications. European equities remain reasonably priced versus many of their US counterparts. They also offer broader and more diversified investment opportunity across different sectors, many benefiting from structural policy tailwind.

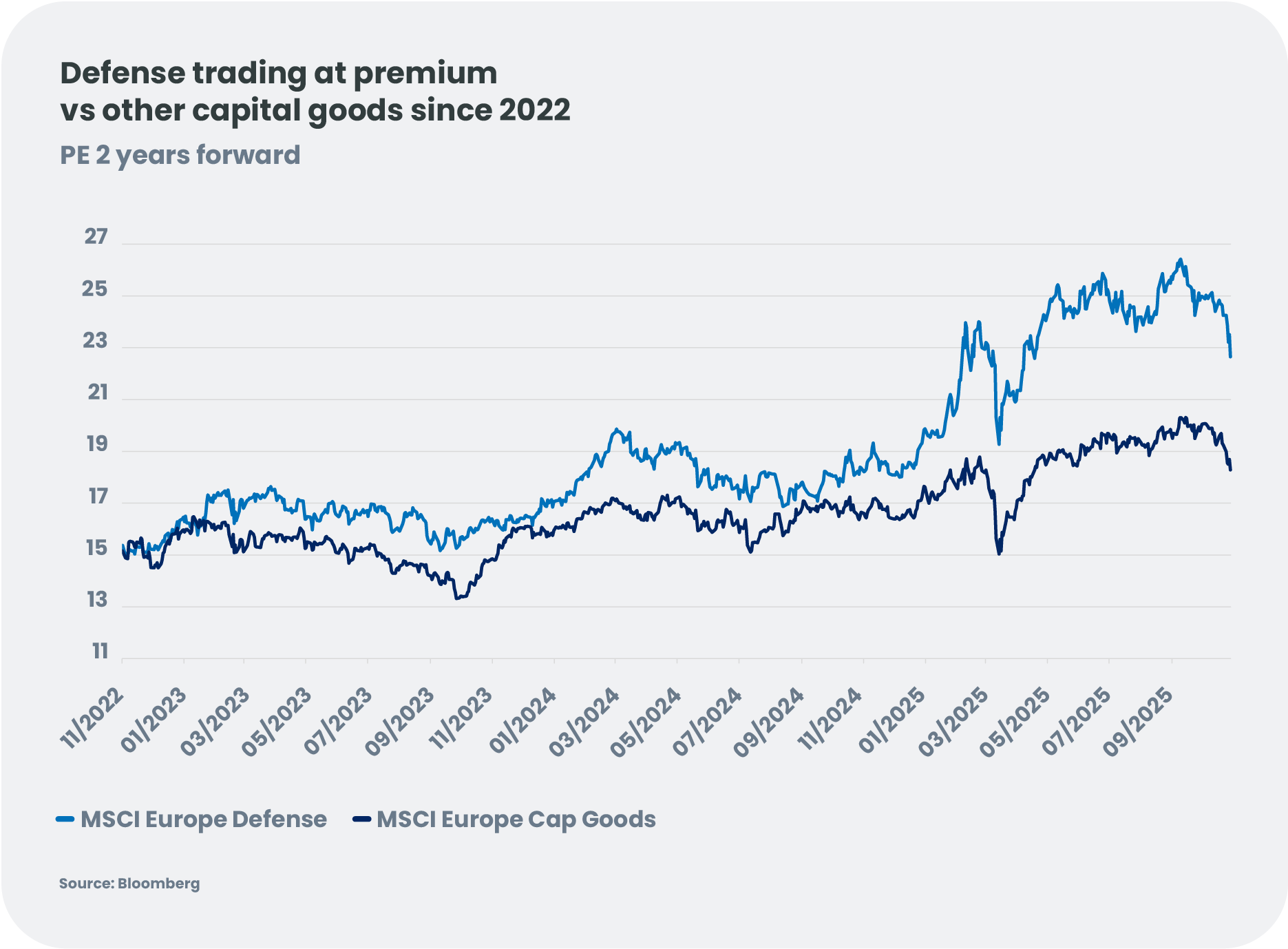

Most visibly, Germany-exposed names as well as aerospace & defence (A&D) stocks have strongly rerated. At current multiples companies are not cheap, but the A&D sector remains rather under-owned[8] which, coupled with accelerating top-line and EPS growth, will make it hard to ignore. Altogether, A&D represent 5% of MSCI Europe (vs 2.75% two years ago). Defence remains under owned by investors giving scope for further momentum.

In terms of sectors, these dynamics may favour more cyclical and domestic stocks and those that offer unprecedented access to key technologies:

- Aerospace and defence: Valuation levels are normalising after strong performance and progress in Russia–Ukraine peace talks, creating new investment openings. Spending is expected to hold firm given the persistent Russian threat and the need to rebuild key capabilities. We favour exposure to German defence budgets and companies with promising valuation levels. We also monitor the shift toward long-cycle defence and upcoming IPOs.

- Technology – semiconductor equipment: Europe retains global leadership in critical niches such as lithography and power/AI chips, supporting digital sovereignty and competitiveness, reinforced by policies like the European Chips Act. Rising demand for memory and logic chips points to new capacity needs from late 2026 to early 2027. Valuations across European semiconductor equipment companies have materially compressed from 2024 peaks and remain promising.

- Materials & Construction: The sector benefits from German infrastructure spending, Ukraine’s future reconstruction, and domestic exposure to wider European investment plans. Sub-segments such as cement producers continue to offer opportunities at reasonable valuations.

- Utilities: Utilities are supported by RePowerEU and strong tailwinds from the energy transition, grid congestion, data-centre growth and the drive for energy sovereignty. Regulatory pressure to expand grid investment adds further momentum. Power demand may rebound as industrial activity recovers and AI data centres scale. The sector remains reasonably valued relative to the broader market and continues to trade at a discount.

- Banks: Sector fundamentals remain robust, backed by a resilient EU economy supported by investment plans and fiscal policy. Credit demand may gradually recover through corporate capex and household mortgages. Net interest income appears to have reached a trough as the ECB has paused rate cuts, while European banks remain structurally well capitalised. Overall, valuations do not appear expensive.

- European SMID cap: Smaller caps could offer asymmetric return potential into FY26. They continue to trade at low multiples despite supportive monetary policy, substantial fiscal spending and easing energy and inflation headwinds.

By targeting Europe’s emerging strategic domains, investors can position themselves at the forefront of a transformation that is set to define the continent’s next growth cycle.

Back to our convictions

Back to our convictions