9 December - China

China’s next act: is Beijing emerging as the big winner?

Innovation, policy resets, and strategic resilience redefine China’s path to global leadership.

As China moves into its next phase of economic and technological transformation, it is poised to emerge as a major winner in a fragmented global landscape. Although challenges remain—slow consumption, property-sector strains, and external uncertainty—the one-year trade truce and the launch of the 15th Five-Year Plan are lifting prospects for a more stable, innovation-led recovery. For investors, this evolving backdrop is unlocking fresh opportunities and reshaping risks across equities and fixed income, setting the stage for a more dynamic and growth-oriented market environment in 2026.

China’s Macro Pulse: From Truce to Transformation

China remains on track to meet its 5% GDP growth target for 2025[1], supported by solid first-half performance, moderate Q3 growth, stronger exports, and rapid advances in technology—highlighted by this year’s “DeepSeek moment” in AI innovation. Yet, the recovery is uneven. A weak property sector, lingering deflationary pressures, and cautious household sentiment continue to weigh on momentum, while U.S. tech restrictions and tariffs influence business confidence.

Rather than broad stimulus, policymakers are relying on targeted measures to support consumption in areas such as EVs and home appliances, alongside regulatory steps to strengthen capital markets and curb excessive competition. These measures aim to stabilise demand while promoting more sustainable industry dynamics.

This domestic recalibration is unfolding alongside a temporary easing in external pressures. U.S.–China trade relations have entered a period of relative stability after the late-October meeting between Presidents Trump and Xi in South Korea, which produced a one-year truce with tariff cuts and the suspension of selected export controls. The adjustments lower tariff pressure heading into 2026 and reduces immediate headline risk. Still, uncertainty remains: non-tariff measures or tighter tech restrictions could return as strategic rivalry continues, particularly in technology and rare earths. Concurrently, China has strengthened ties with non-U.S. trading partners to build supply-chain resilience and diversify export markets.

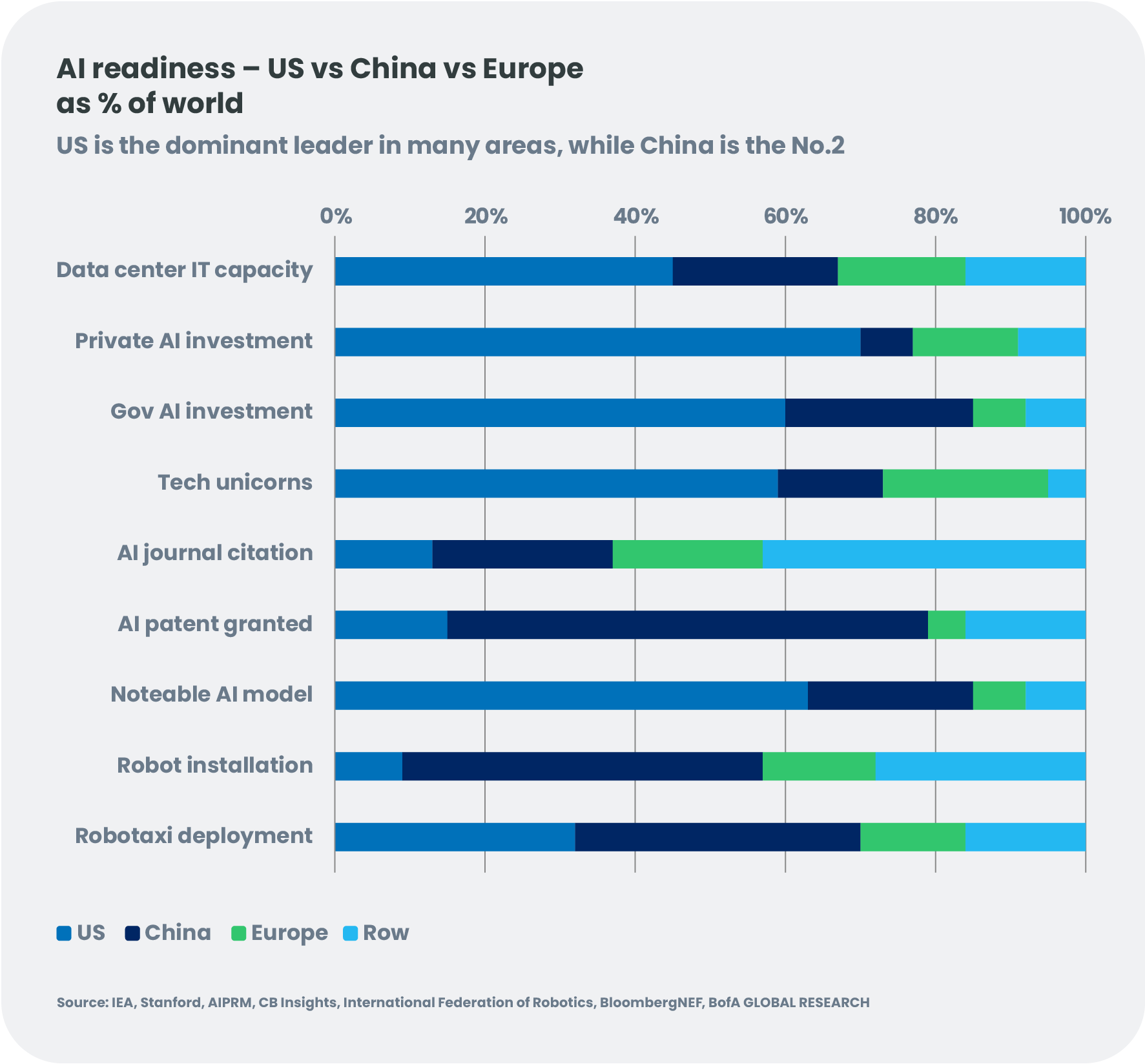

This combination of targeted macro policy and improving external conditions sets the stage for the launch of China’s 15th Five-Year Plan (2026-2030). The plan drives innovation-driven growth, emphasising technological self-reliance, resilience to external shocks, and the upgrading of the industrial value chain. Strategic priorities include semiconductors, AI, and advanced manufacturing, creating significant opportunities for both domestic and global businesses. Ultimately, the agenda reinforces China’s commitment to sustainable growth and competitiveness through innovation.

China as a Global Power

China has solidified its role as a central pillar of global economic and geopolitical influence. As the world’s largest trading nation and second-largest economy, it shapes global supply chains, commodity markets, and manufacturing networks. Its expanding capabilities in AI, electric vehicles, telecommunications, and renewable energy are reinforcing its strategic autonomy and challenging long-standing Western leadership in key industries. Diplomatic and financial engagement—from the Belt and Road Initiative to a growing presence in multilateral institutions—continues to amplify Beijing’s international reach. These economic, technological, and security dimensions make China an increasingly influential global power—albeit at times contested.

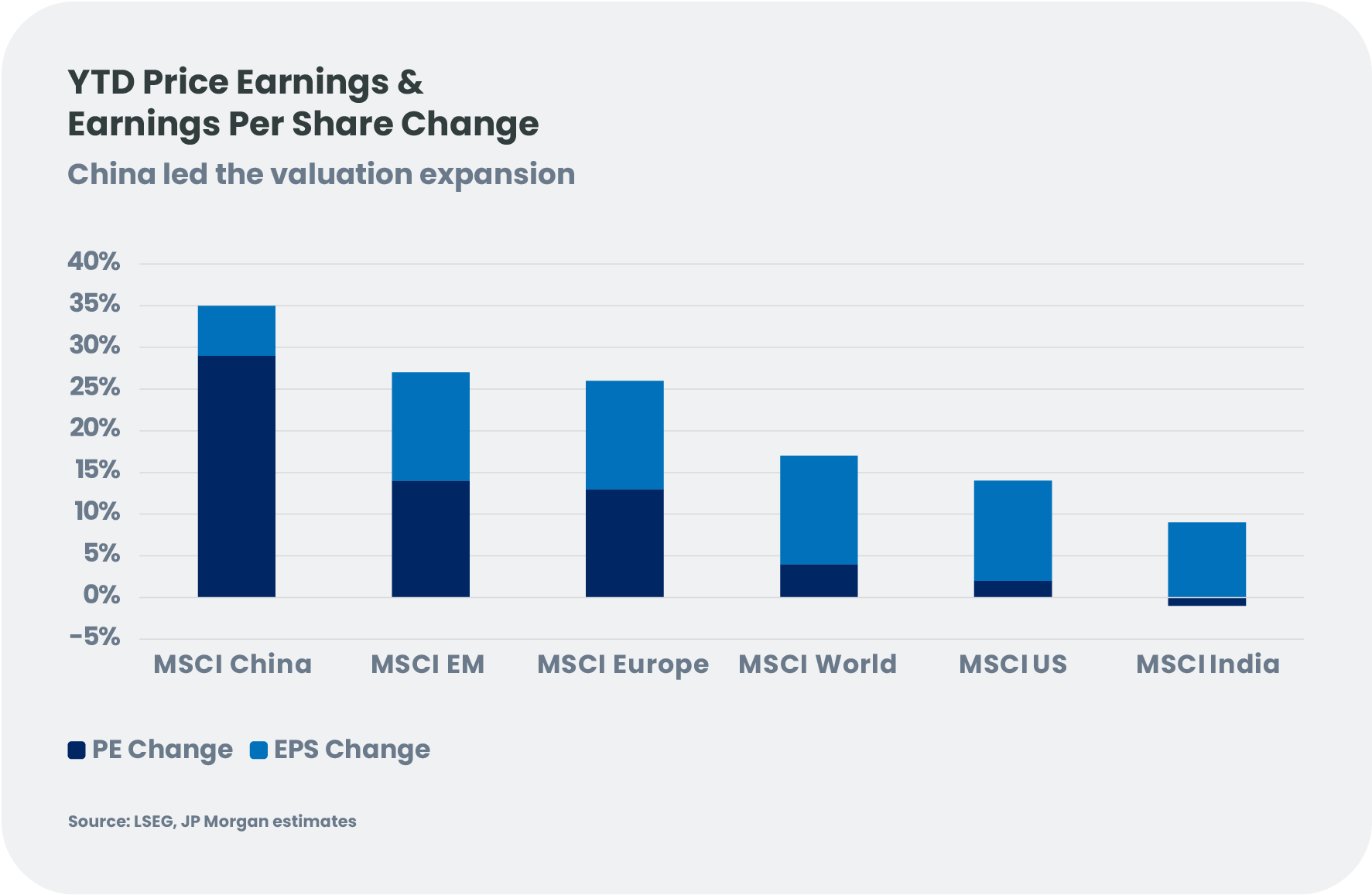

Equities: Positioning for China’s 2026 Upswing

We expect earnings growth for Chinese corporates to accelerate in 2026, supported by policy tailwinds and profitability improvements from anti-involution measures. The equity market is likely to transition from a liquidity-driven rebound in 2025 to a more earnings-based recovery in 2026. Potential catalysts for re-rating include:

- Incremental accommodative macro policies

- Lower risk-free rates

- Capital inflows from reallocation of residential investment, onshore institutions, and global investors toward China and emerging markets.

Building on this earnings-led backdrop, we have a constructive stance for industry leaders with proven innovation capabilities and clear global expansion strategies. Anti-involution reforms should encourage corporates to pursue broader global market share supporting margin improvement. Chinese biotechnology firms, benefiting from robust out-licensing deals in 2025, are expanding their international relevance through deeper innovation pipelines.

Technology self-reliance remains a core investment theme. We are constructive on secular demand for power infrastructure, data centers, GPUs, memory, advanced chips, robotics, humanoids and semiconductor equipment. While mindful of potential AI valuation excesses, Chinese AI-related equities still trade at a discount to U.S. peers, offering selective opportunities. Later in 2026, we anticipate gradual recovery in consumption, supported by rising household income from corporate earnings growth, though the pace will be steady rather than sharp.

From a style perspective, we maintain a preference for growth and cyclical sectors over value and defensives in the medium term. Companies with strong R&D, robust liquidity and global ambition are best positioned to benefit from structural trends and rising passive inflows.

Fixed Income: Strains Persist, Opportunities Remain Selective

China’s credit environment remains pressured by property-sector deleveraging, weak domestic demand, and subdued private-sector credit creation. While the Five-Year Plan aims to accelerate industrial modernisation and bolster consumption, demographic challenges and persistent deflationary tendencies suggest that recovery in household and corporate appetite will be gradual.

In this environment, China’s yield curve is likely to remain firmly anchored, with limited room for steepening as authorities prioritise financial stability over aggressive easing. For credit investors, this calls for selectivity across both corporates and sovereigns. We continue to favour high-quality issuers in sectors aligned with policy priorities, such as commodities linked to industrial upgrading and high-tech manufacturing supply chains, though valuations near five-year tights require discipline.

The renminbi remains appealing as a funding currency, supported by some of the lowest yields in emerging markets. Although it is on a gradual appreciation path, the pace is modest, and other emerging market currencies currently offer more compelling opportunities. Chinese rates likewise offer limited appeal: carry is thin and the outlook for further easing is uncertain after several rounds of policy support that have delivered diminishing results.

Conclusion

China’s drive for technological leadership is now a cornerstone of its long-term national strategy. U.S. technology restrictions on China, once a headwind, have become a catalyst for innovation and accelerated investment in critical technologies.

Despite ongoing macro challenges, China’s equity market offers compelling long-term opportunities driven by structural reforms, earnings recovery and a maturing innovation ecosystem. We see interesting prospects for industry leaders across the technology value chain, supported by gradual macro stabilization and narrowing producer price contraction. These dynamics may position Chinese equities for a more balanced and durable recovery in 2026.

On the credit side, we believe opportunities will persist, although dispersion will continue to rise, making disciplined issuer selection essential as China’s transition unfolds. As China reshapes global trade, technology, and capital flows, its next act will play an increasingly defining role in global markets.

Back to our convictions

Back to our convictions