17 December - Credit

Are credit markets approaching a crossroads?

While private credit and high yield markets will continue to offer opportunities in 2026, rigorous selection becomes essential for investors.

Although recent credit events have not disrupted the broader credit cycle, the increasingly complex macroeconomic environment, rising capex and the elevated LBO activity are fueling concerns. Are issuers at the lower end of the credit spectrum so resilient?

Emerging cracks in credit. Should investors worry?

Recent U.S. bankruptcies have renewed scrutiny of valuations, transparency, and systemic exposure across the riskier parts of the credit spectrum. These concerns are emerging while high yield spreads remain tight, private credit valuations are heterogeneous, and allocations to private credit have expanded markedly across investor types.

The collapse of the auto supplier, First Brands, has sent shockwaves through the leveraged loan market, with CCC-rated loans on pace for their worst year since 2022[1]. Subprime auto lender, Tricolor, also came under severe pressure. This backdrop has contributed to a widening of U.S. high yield spreads after reaching a low of 268 bps in September[2], a level at the bottom quartile of the past two decades. The auto sector has been particularly affected, with the most leveraged issuers registering the most pronounced widening. Despite these pockets of stress, there is no evidence of systemic risk. In our view, the two failures appear largely idiosyncratic, tied to specific fraud or isolated business practices. Moreover, they are not linked to debt but primarily to bank-arranged structures, with private credit exposure limited to small secondary positions.

Yet, they have triggered concerns on the health of credit markets overall, notably in a context where private credit markets, by design, operate with far less transparency than public bond markets—with limited price discovery, inconsistent reporting standards, and heterogeneous valuation methodologies across managers. Valuations can vary significantly across lenders or Business Development Companies (BDCs) for the same underlying loan, complicating the assessment of portfolio conditions.

Concerns have also been heightened as private credit exposure has grown materially across banks, insurers, mutual funds, and more recently retail investors. In the U.S., the private credit market is now approaching 1.4 trillion dollars[3], rivalling the size of the high yield bond market. Its rapid expansion reflects three key drivers: tighter bank lending regulations, borrower appetite for customised and flexible solutions with rapid execution, and strong demand from institutional—and increasingly retail—investors for high floating-rate income, low volatility, and portfolio diversification.

The situation is slightly different in Europe.

European private credit: the lower mid-market offers stability and performance by design

Europe’s private credit market is expected to double in size and approach 1 trillion euros by 2030, according to Preqin. While the U.S. private credit market is larger and more mature, Europe is smaller but growing at a faster pace. Bank retrenchment is no longer the main growth driver; instead, demand is shifting toward bespoke capital solutions in the deep lower mid-market, from both private equity sponsors and non-sponsored, as family-owned businesses seek customised, non-dilutive financing.

Attractiveness of the lower–mid market

The European private credit market is clearly segmented by transaction size and ownership structure. Large-cap sponsored LBOs face significant pricing and term pressure due to intense competition—driven by abundant private debt capital, steady bank participation, and subdued M&A activity. In contrast, small-to-mid-sized transactions face lower competitive pressure, particularly the sponsorless ones. They also offer satisfactory deal flow and quality with terms that support premium returns and strong risk control (leverage, covenants, protective documentation, Board seat…). The ability to arbitrate opportunities across countries enables to select the deals potentially offering the most compelling risk-adjusted returns.

Unique Local-lender advantage

Europe being a highly fragmented market, a local sourcing model is key to access opportunities. The most attractive deals are typically in companies that are too large for local banks or regional funds, yet still below the threshold of major mid-market players. A local market approach fosters long-term partnerships with borrowers, enabling tailored structuring and sustained financing support.

Sector and portfolio diversification

Lower mid-market portfolios and deal flow across Europe remain highly diversified by sector and profile, and granularity provides resilience through cycles. The sector-specific spikes of 2021–2022 (e.g., software, healthcare) have moderated.

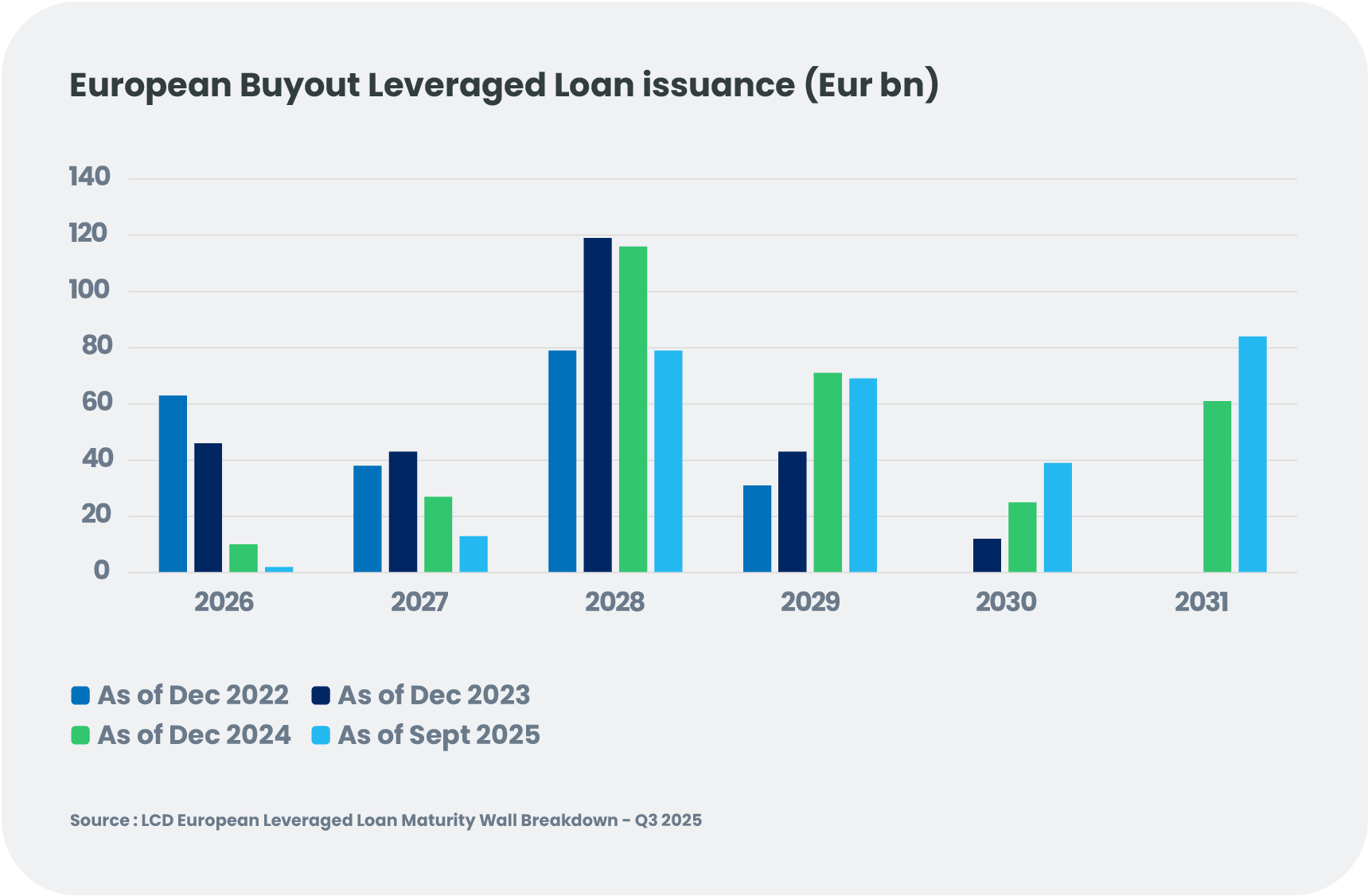

A shifted maturity wall

Record refinancing volumes in 2024—the highest in seven years for leveraged loans—have pushed the maturity wall back to 2028.

On the publicly traded debt side: High yield offers resilience amid shifting dynamics

While high yield carries its own risks, the current market is more defensive than in previous cycles.

Public transparency and liquidity

Public trading provides continuous pricing, agency ratings, and audited financials, delivering mark-to-market visibility and reliable liquidity that private markets cannot match.

Higher Quality–Duration Profile

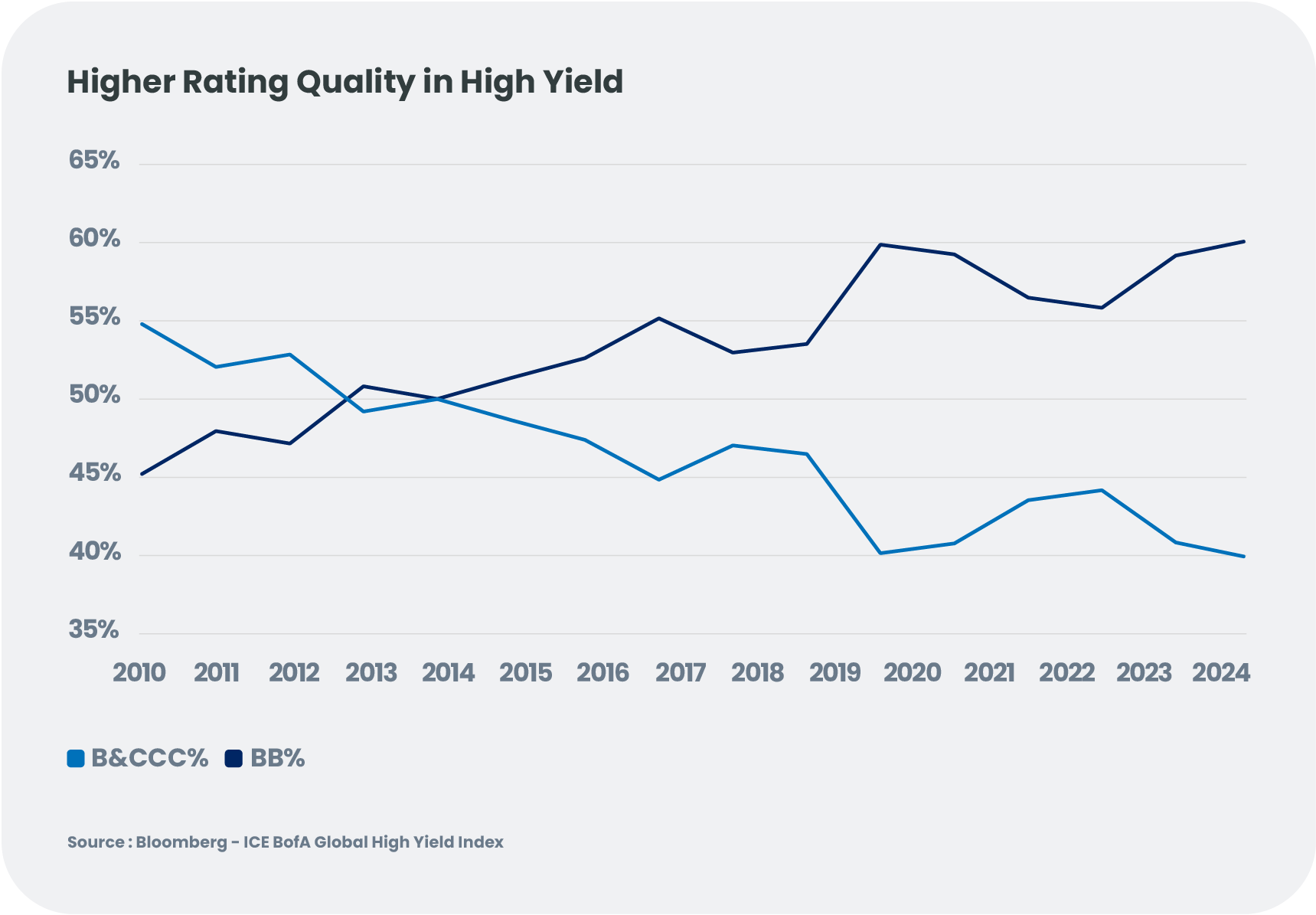

High yield duration, near all-time lows, reduces interest-rate sensitivity and offers defensive characteristics relative to the rest of the credit spectrum.

BB-rated issuers—many of them fallen angels—represent a historically large share of the market, resulting in far less distressed exposure than in prior cycles. We expect more fallen-angel activity in 2026, but not enough to erode the asset class’s quality buffer.

Technical Strength from Scarcity

The high yield market enjoys favorable supply-demand dynamics. Post Covid, High Yield supply has remained limited as many companies used cheap money and strong earnings to pay down debt or delay refinancing. Coupled with higher borrowing costs since 2022, this led to limited net new supply of bonds. With many bonds maturing without replacement and issuers actively deleveraging, investors now face a scarcity of paper rather than an oversupply. Next year, we expect HY refinancing volume to increase, supported by a more aggressive near-term maturity wall. Issuers delaying refinancing amid high rates are expected to hit the market on Fed cuts. We also expect overall M&A/LBO activity to pick up. Overall, high yield technicals are set to drift towards more neutral territory.

Resilient sector composition

Concentration in energy, telecoms, healthcare, and basic industries limits exposure to AI-driven disruption. While some issuance comes from Neoclouds and hyperscalers, most supply pressure is expected to migrate toward the investment grade market.

Selectivity will be essential as we approach 2026

The current macroeconomic environment underscores the need for a disciplined approach as challenges such as low GDP growth, rapid Ai-driven technological shifts, and increasing regionalisation affect all sectors. In the high yield space, this environment demands active management and rigorous issuer selection to capture idiosyncratic opportunities. In the private credit space, this reality translates into greater selectivity and longer deal execution timelines to ensure thorough due diligence. For investors, these two asset classes offer strong complementarities, creating granular and varied opportunities for diversified portfolio construction.

For 2026, we expect:

- default rate to remain manageable

- more M&A activity and leveraged buyout transactions essentially in the U.S.

- strong investor interest for high yield and robust capital raising by major private debt lenders

- high yield to maintain relative resilience due to a strong quality mix and a tight supply-demand balance.

- the European lower-mid and sponsorless segment to remain one of the most resilient areas in private debt.

- increasing differentiation across private credit managers based on valuation discipline.

We are clearly in a credit-picker market. Rigorous underwriting, selectivity, diversification and active portfolio management will be essential, with investors who focus on resilient business models and sustainable capital structures best positioned to capture value as the cycle advances.

Back to our convictions

Back to our convictions