7 December

Can equities fall, even 'without' a hard landing?

With the failure of a recession to materialise, 2023 has been a good year for equity indices. However, their rise was uneven, marked by strong selectivity among mega-caps in the US and underperformance by small and mid-caps, hit by the historic rise in interest rates.

For 2024, we anticipate a continued soft landing for the developed economies and stabilization of the Chinese economy.

But can we rule out the risk of a downturn in the equity markets?

The challenge of high real interest rates

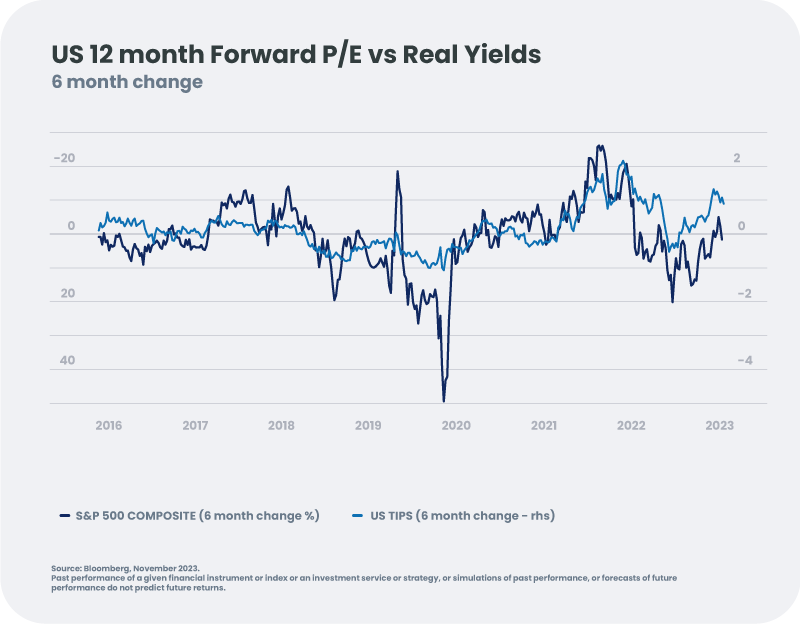

High real bond yields are traditionally unfavourable to the expansion of price/earnings (P/E) ratios. Nonetheless, it was a rise in valuations that carried equity markets into 2023, against a backdrop of stronger-than-expected economic growth.

In 2024, we expect growth to slow and inflation to continue to fall, putting downward pressure on real rates and creating a favourable environment for stock market valuations. However, given the rate levels already reflected in equity valuations, we believe that this support will be relatively weak or non-existent.

Support from margins and profits in 2024?

While valuation is unlikely to provide additional support for equities, weak but positive growth should nonetheless bolster corporate earnings. But to what extent?

For 2024, our economists forecast GDP growth of +1.9% in the United States and +0.5% in Europe (that is, a "soft landing"). Historically, these levels are compatible with corporate earnings growth of +7.5% in the United States and +2.5% in Europe. However, markets are already discounting higher levels for 2024 (+12% in the US and +6.5% in Europe), which should lead to a downward revision of earnings expectations for next year - especially as companies are likely to face further pressure on their margins.

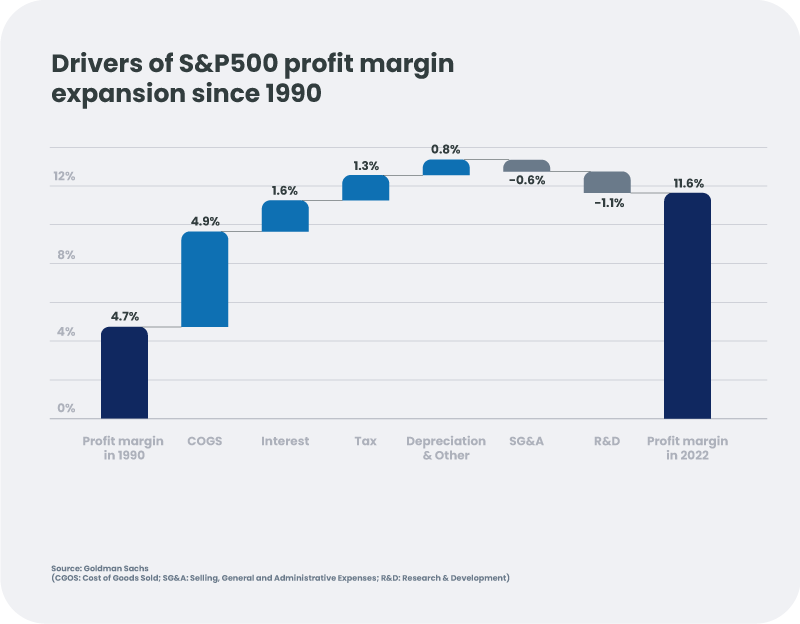

On the one hand, profit margins are high in all regions, exceeding pre-Covid levels. With real wage growth likely in 2024, these margins should be harder to preserve.

On the other hand, since the 2000s, companies have benefited from steadily falling bond yields, widespread tax cuts and globalization. This positive sequence could be coming to an end, due to:

- Growing government financing needs, at a time when debt levels are already high following the fiscal efforts made during the pandemic. Withholding tax rates have begun to rise (pressure on the banking sector in Italy, Belgium and Spain to introduce an "exceptional" tax; voted by the US Congress for a 15% minimum tax rate for large corporations and a tax on share buybacks), and this trend could continue into 2024.

- The end of ultra-accommodating monetary policies, which should lead to a lasting increase in corporate financial costs.

- Recent supply shocks, which are likely to affect company margins.

Given these downside risks to current earnings projections, we remain cautious about the ability of earnings growth to provide strong support for equity markets in 2024.

Moreover, we believe the good news has already been incorporated into valuations.

Consequently, although we do not anticipate a "hard landing" (sharp recession), the scenario of a horizontal equity market seems to us the most likely, with limited upside potential.

Which regions and sectors to favour in 2024?

While the equity market as a whole lacks catalysts, there are nonetheless some attractive themes and sectors.

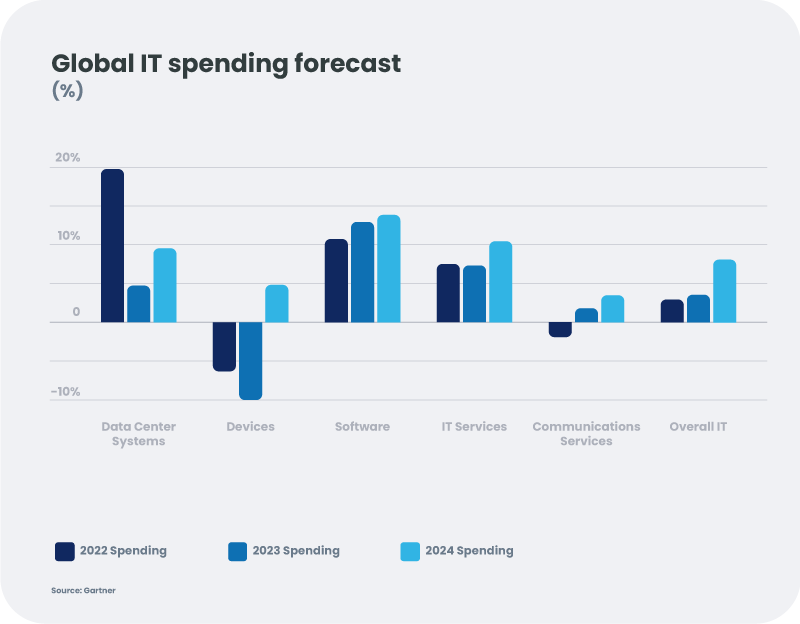

In the US, technology stocks should continue to outperform, taking advantage of their innovation capabilities, notably through the monetization of Cloud and AI services (+10%[1] of investments next year). Strong balance sheets and low debt levels make the sector even more resilient in the face of an economic downturn. Valuations appear reasonable in view of the sector's expected long-term growth.

In emerging markets, we see opportunities in Latin America, which should continue to benefit from the relocation of American industry ("nearshoring") against a backdrop of resilient commodity prices. Modest earnings growth expectations, moderate valuations and a supportive central bank environment should buoy the region's markets, especially Brazil, which is implementing fiscal reforms.

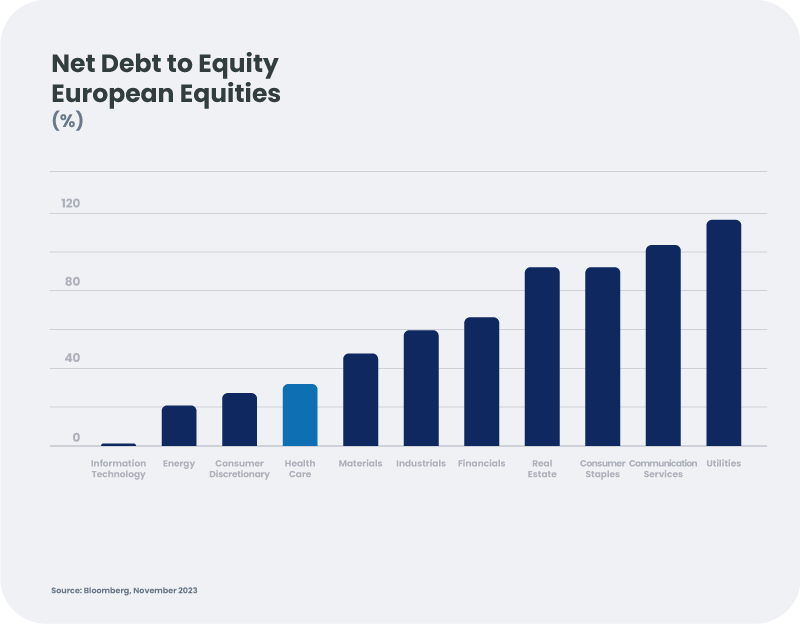

In Europe, the economic situation remains more gloomy, with weak growth and no visible catalyst in the coming months (persistent volatility in energy prices, high key interest rates, Germany’s need to reinvent itself). As such, we favour companies that are best positioned to defend their margins, have strong balance sheets and can benefit from lower rates in 2024, such as healthcare and consumer staples stocks.

- Healthcare stocks, with the exception of certain issuers such as Novo Nordisk[2], have mostly underperformed the market in 2023. They should play a defensive role in 2024, their capacity for innovation supporting margins, while their business seems to have normalized post-pandemic. They benefit from good visibility on their cash flow progression in the absence of major patent expiries before the end of the decade, and with the possibility of being positively surprised by the arrival of newly developed drugs. The sector's low level of debt is also an advantage in a high interest rate environment.

-

Consumer staples have significant pricing power, enabling them to maintain high margins while enjoying good visibility on their business. The sector's valuation has undergone a significant adjustment due to rising rates in 2023, and should benefit from a more favourable environment in 2024. Last but not least, the sector's defensive nature enables it to outperform in an economic slowdown.

To sum up, 2023 was a good year for equities, albeit with a high degree of dispersion. In our assumption of a continuation of the soft landing for the developed economies in 2024, the scenario of a horizontal equity market seems to us the most likely, with limited upside potential. We also see relatively little downside potential, given the room for manoeuvre that central banks have built up again. The stressful episode surrounding US banks in March showed us that the Fed is always ready to manoeuvre when necessary.

We prefer to avoid highly leveraged stocks, and instead to select companies offering resilience and visibility in this slowing environment.

In the US, technology stocks should continue to generate growth, although the scale of the outperformance achieved in 2023 is difficult to reproduce. In Europe, we favour quality defensive stocks.