23 December - Impact Investing

Impact Investing: fading priority or enduring commitment?

Impact investing can align tangible outcomes with financial outcomes, potentially a path to restoring confidence in sustainable finance.

Dynamics are changing, and priorities are being redefined. Governments, companies, and investors alike are reassessing their allocation of resources. In this environment, impact investing faces an important question: does it remain a long-term commitment, or does it risk becoming a secondary priority?

1. Time for change

Geopolitical fragmentation is fundamentally reshaping global priorities. Governments that once placed sustainability and climate risk at the forefront of their agendas are increasingly recalibrating toward national security, trade resilience, and technological sovereignty. Companies are being forced to adapt rapidly -- securing access to energy and critical raw materials, strengthening cybersecurity, and accelerating technological innovation.

Yet climate change risk is becoming a financial risk. Rising frequency and severity of extreme weather events is driving substantial economic losses worldwide, exposing vulnerabilities across value chains. Business models must evolve to cope with natural-resource constraints, to integrate climate-related risks, and to build resilient infrastructure capable of operating under new environmental realities.

With public budgets increasingly constrained, the role of private capital becomes even more essential. Financing the transition to a more sustainable and secure economic model relies heavily on investors, and demand continues to grow for impact-driven strategies able to demonstrate measurable contributions to societal and environmental objectives. Private investment is not only complementary to public action, it is pivotal in enabling long-term, systemic change.

2. Impact investing enters its next chapter

Investors are shifting towards outcome-driven strategies that demonstrate what capital is actually achieving, not just what is being measured. Tangible outcomes are becoming central for investors, and impact strategies one of the strongest ways to meet this expectation.

The first decade of impact investing raised awareness of externalities and opened a more direct way to align capital with broad sustainability goals. The current phase is about execution: financing companies and projects that address concrete needs in energy, resource efficiency, health, education, digital inclusion and social infrastructure.

Impact investing is evolving into a more rigorous discipline built on:

- Intentionality – clear objectives and theories of change.

- Measurability – defined baselines, relevant KPIs[1] and independent verification.

- Accountability – incentives and governance that link outcomes to financial terms.

- Economic rationale – strategies aiming to achieve competitive, non-concessionary returns.

Impact strategies in listed equities and bonds are expanding through targeted allocations and active stewardship. Yet key challenges remain: demonstrating additionality (incremental value) in public markets and ensuring consistent, reliable impact data. Public assets can scale impact reach, but private markets still offer the deepest levers for intentionality and measurable change.

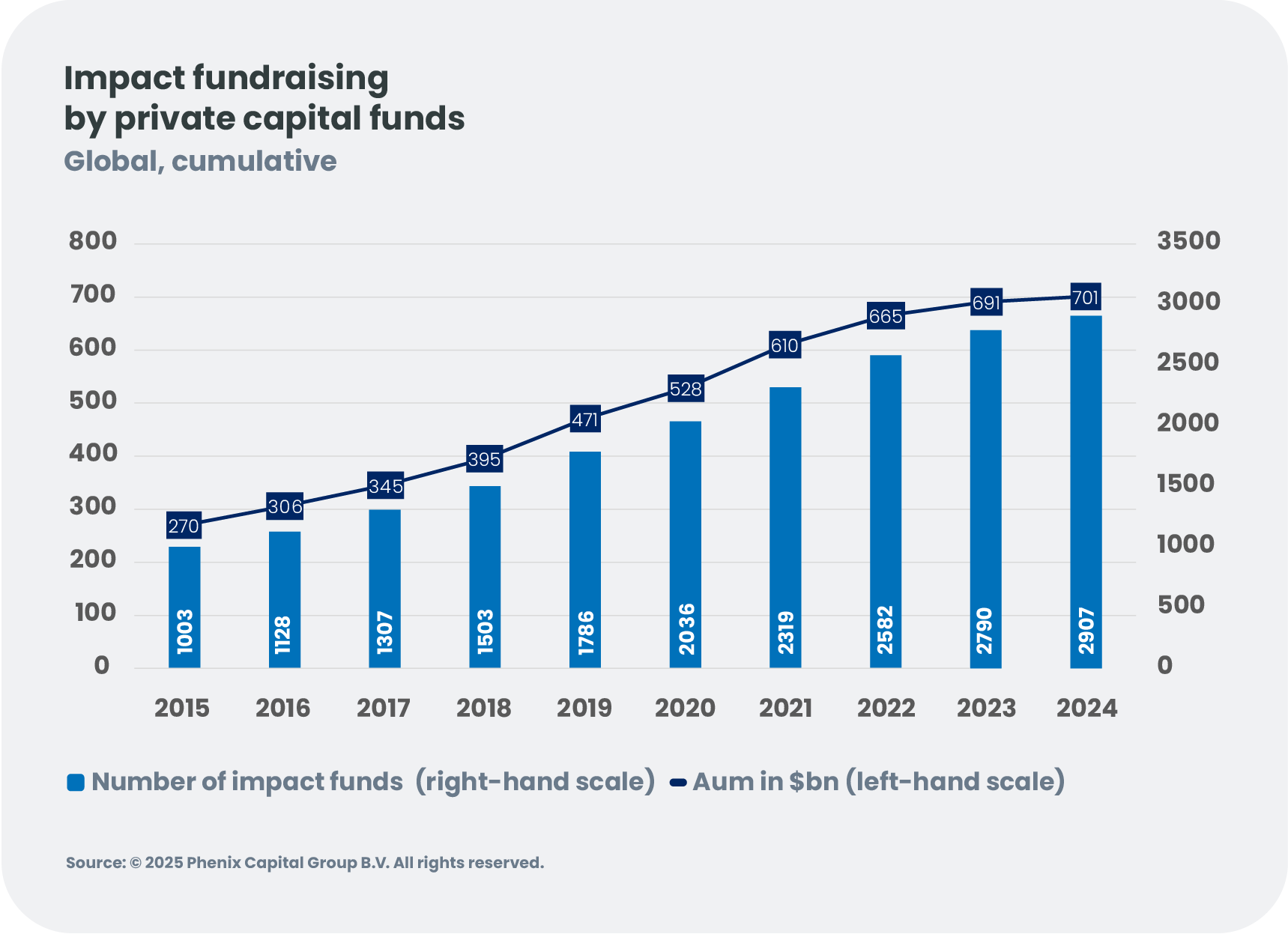

Impact assets under management in the private markets have continued to grow in recent years, even as the broader sustainability narrative has become more contested. In private markets, currently the largest segment of impact investing, assets have grown at roughly 21% CAGR over the past five years,[2] showing that capital is not retreating but re-focusing on strategies where impact can be evidenced and aligned with long-term financial performance.

3. Why private markets are so well-suited to impact

Within this maturing landscape, private markets -– and especially private equity -– are emerging as one of the most effective levers to deliver impact. Four features in particular make private capital stand out:

- Influence and access: Private equity governance rights and private debt covenants place investors directly at the operational levers of change. Active ownership is not optional, it is structurally embedded. Investors can work alongside management teams on strategy, capex, capital structure and sustainability roadmaps.

- Customization: Financing instruments include material KPIs (tC02e/ton,[3] kWh/m2,[4] water leakage, workforce indicators, recycling data), with clear baselines, verification requirements and stepwise pathways.

- Additionality: Initially, impact investing funded projects which would otherwise not have found financing, raising awareness. Today, impact considerations are becoming core drivers of business decisions -- from electrification and industrial efficiency to circular materials and water systems -- where conventional lenders or public budgets are unlikely to meet the need.

- Time-horizon fit and measurement: Multi-year holding periods align with the time required for genuine transformation. Private reporting frameworks provide access to granular data, making impact auditable, comparable and useful for decision-making for investors and stakeholders.

These characteristics explain why a growing share of impact capital is being invested in private strategies: they offer a clearer line of sight from capital to outcomes.

4. How does private equity mobilise capital for the economy of tomorrow?

Within this landscape, private equity stands out as one of the most effective ways to translate impact intentions into tangible business transformation.

Impact in private equity has evolved from a mission-driven niche to a core approach for financing transformation. Under this approach, value creation is tied to business models that generate measurable social or environmental outcomes, for which sustainability becomes one of the drivers of financial profit.

Impact PE scales high-impact solutions in areas such as renewable generation and storage, energy-efficient buildings and industry, circular production capacity, sustainable supply chains and natural-capital accountability. It also supports existing companies adapting to resource constraints by funding project-specific transition capex and operational change.

Beyond climate, demographic shifts and constrained public budgets create urgent financing needs. Impact private equity is increasingly backing social infrastructure, from affordable healthcare networks and education technologies to digital-inclusion platforms.

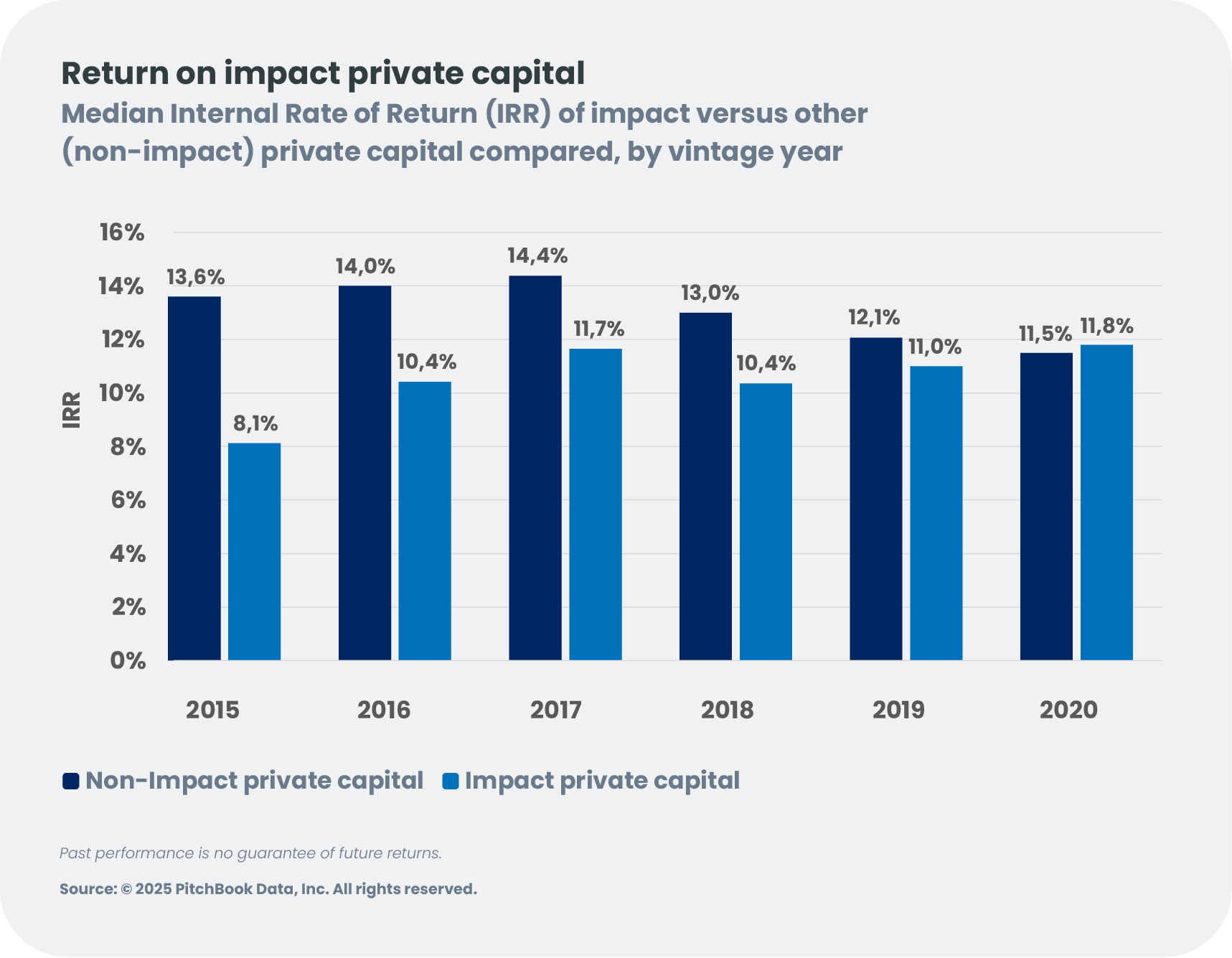

The evidence to date suggests no structural return penalty for impact strategies in private equity. In many cases, exposure to long-term sustainability trends and more resilient business models can enhance the robustness of cashflows over time.

5. Where is impact investing headed in 2026?

Based on our research and discussions with clients, companies and market participants, we see several key trends shaping impact investing in 2026 and beyond:

- Outcome-focused impact. Greater emphasis on credible baselines, KPIs and evidence of meaningful contribution — for example, linking financing terms or investment decisions to measurable reductions in emissions intensity, improvements in resource efficiency, or expanded access to essential services such as healthcare or education.

- Resilient business models. Companies across sectors are rethinking their operating models in response to resource constraints, digitalisation and climate pressures. Those integrating resource efficiency, data and technology, and adaptation measures are strengthening their long-term competitiveness — making this reinvention a growing investment theme.

- Innovation as a growth engine. Economic growth has always relied on innovation, but impact investing targets innovative solutions to specific environmental and social needs, not just disruptive business models. Tomorrow’s economy will depend on clean energy and storage, electrification, circular and low-carbon materials, water systems, digital infrastructure and nature-based solutions – capital-intensive, long-cycle projects with clear impact metrics, well suited to patient, actively managed private capital. Backing both innovators and incumbents adapting their models allows investors to support this transition while linking value creation to measurable real-world outcomes.

- Private markets capture new investment flows. Private equity continues to lead in impact allocations, while impact private debt is emerging as an essential complement, using sustainability-linked structures to finance transition capex and social infrastructure.

- Institutional investors step up. Impact investing among institutional asset owners is moving from scattered initiatives to a more systematic, mainstream allocation. Large pension funds and insurers are no longer asking whether to invest in impact strategies, but how to scale it credibly across asset classes, with clearer governance, measurement and evidence on financial performance. Given the size of their balance sheets, even modest impact allocations can materially influence how entire sectors and systems evolve.

Investing with impact: the road ahead

Our question: is impact investing an enduring commitment or a fading priority?

We believe the evidence points clearly in one direction. Impact investing is enduring, but in a different form: more focused on outcomes, more demanding in terms of measurement and accountability, and more closely integrated into core investment strategies.

Private markets, and particularly private equity, are at the heart of this evolution. They offer the influence, flexibility, and time horizon needed to turn capital into meaningful change across climate, nature, inclusion, and innovation.

For investors, the choice is less about whether to add impact assets to a portfolio, and more about how to position portfolios for a world where sustainability and long-term value creation are increasingly intertwined. In many ways, impact investing is helping shape tomorrow’s economy, redefining how capital drives resilience, innovation, and long-term growth. Those who adapt early will not only support a more resilient and productive economy – they will also be better-placed to capture the opportunities that this new phase of impact investing can offer.

Back to our convictions

Back to our convictions